You can now prompt donors after the transaction has been made, to provide the details required for your charity to process Gift Aid, and to hear more from you by email.

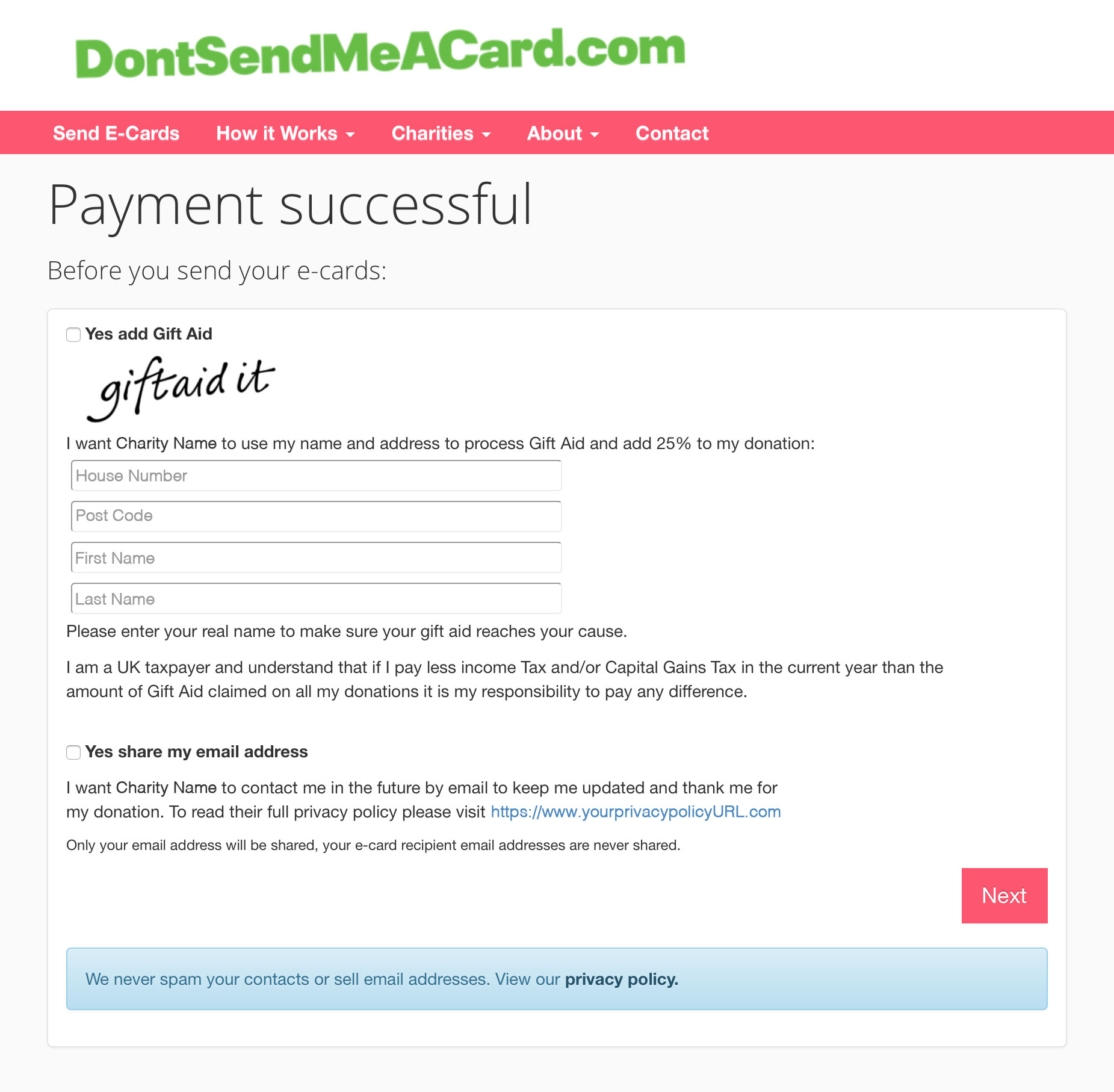

What Donors See

After donating a screen appears thanking them, providing them with unticked consent boxes to elect to share their details required for you to process Gift Aid and hear more by email.

Unlocking Gift Aid & Donor Email features

To unlock these features you first of all need to link to your own Privacy Policy or Notice.

1. Login to your charity account dashboard

2. Click on Edit Profile

3. Enter a valid URL in the 'Privacy Policy' field

Activating

Once your privacy policy URL is in place, you can turn on these features in the section entitled 'Collect Gift Aid and Donor Emails' in your account dashboard.

You can turn this off at any time if you no longer wish to collect this information.

CSV Reports

In the same section 'Collect Gift Aid and Donor Emails' in your dashboard you'll find links to download the CSV files. These secure links to the CSV reports appears on this page once users start to elect to share.

A full CSV report with 'All Transaction Data' is available from this page in the dashboard too. Please login and read our Guidance PDF available on the Gift Aid and Donor Email page with more details.

How Collecting Data Works

Both of these options are presented after the transaction has taken place, before they send their e-cards.

The Gift Aid feature captures: First Name, Last Name, First Line of Address, Postcode, Amount Donated, Transaction Date and Time, Transaction ID. Your charity can then use that information to process Gift Aid and add 25p to every £1 donated.

The Email feature captures: Email Address, First Name, Last Name. Your charity can then add these emails to your newsletter or mailing list, and thank them for their donation by email.

Security

Donor details are only downloadable over SSL encryption via your account dashboard. You can read our Privacy Policy last updated November 2021. Or read our section 'Data & Security' on our FAQ.

Claiming Gift Aid on the Gross amount donated

Many charities ask us if Gift Aid should be claimed on the Gross or Net amount:

- Gross amount example = £10 (amount donated before PayPal transaction fees)

- Net amount example = £9.23 (actual amount charity receives after PayPal fees are deducted)

According to this guidance from HMRC under 3.4.4 "the gross donation paid is eligible for Gift Aid". So we suggest that you claim on the Gross amount.

You can use the DontSendMeACard CSV reports as your 'audit trail of administrative fees' to show the transaction fees that have been charged on the donations by PayPal via DSMAC.

Premium Features

We don't charge to access to these premium features, but we do require that you link through to your landing page on DontSendMeACard.com following these instructions so that supporters know to give to your charity via the initiative.

Recommended Steps to Get Started

1. Link to your landing page

2. Upload custom e-card artwork

3. Email your supporters about the initiative

4. Schedule social posts